The Ultimate Investing Platform

Use Your Solo 401k Checkbook To Invest In Virtually Any Asset

"This Really Does Work. I'm just so glad we did this!"

Larry F

Solo 401k Owner

Founder of Sozo Investments

TAX-FREE UNLIMITED ROLLOVERS

Rollover Cash

Unlock The True Value Of Your Pre-Existing Retirement Funds—Rollover existing IRA, 401k, 403b, 457, Keogh money and more!

INTEGRATED BROKERAGE ACCOUNT

Rollover Stocks, Bonds, Funds and Other Traditional Assets

No more compromises! Get total control of your retirement funds with the Solo401k.com Unlimited® Investing Platform that allows you to keep your access to traditional investments.

SAVE BIG ON TAXES EVERY YEAR

Make Enormous Contributions From Business Income

Let's face it—the financial system is rigged in favor of entrepreneurs. Self-employment income contributions of up to $59,000 per year can be made into the Solo 401k!

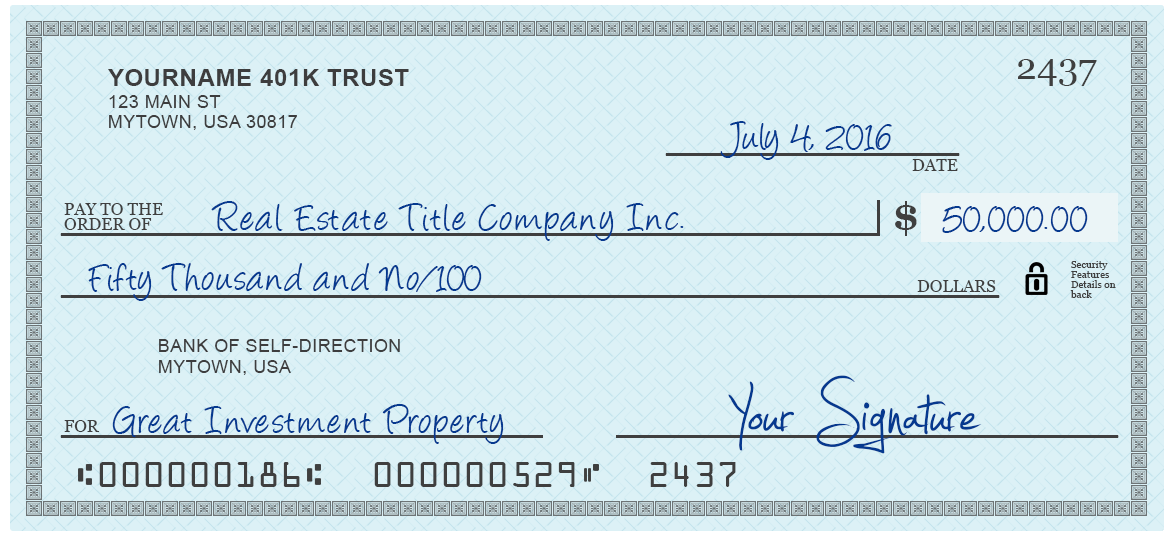

INVESTMENT EXAMPLE: DIRECT OWNERSHIP OF REAL ESTATE

Purchase Investment Property

You simply sign the contract as Trustee of your Solo 401k and write an official check for the earnest money deposit.

THE PAYOFF

Receive Full Profits Into Your Solo 401k

Fortunately, all the profits go right into the Solo 401k without getting taxed first. This allows the full compound growth to occur much faster than with investing taxable money.

What Solo 401k Owners Are Saying

LEARN FROM THEIR EXPERIENCE

We've been the leader in self-directed IRAs and Solo 401(k)s since 2004.

We co-developed the IRA LLC strategy with attorney Debrah Buchanan and our CEO Jeff Nabers launched the world's first fully self-directed Solo 401k platform.

The most successful investors out there use Solo401k.com.

Get Your Own All-In-One Solo 401k Investing System

No Custodians or Third Party Administrators Required. 100% Self Directed.

What Kind Of Difference Could This Make For You?

TARGET HIGHER RETURNS WITH SELF DIRECTED INVESTING

Imagine two scenarios:

One with typical modern performance from the stock market.

The other targeting a 10.00% return per year, which is possible for self directed investors.

Both start with a $100,000 investment and invest an additional $20,000 per year.

Is This Legal?

LEGAL SINCE 1990

The origins of the legitimacy of the fully self directed IRA lie in an obscure piece of microfiche buried in Washington, D.C. uncovered by attorney Debra Buchanan.

After conferring with the IRS and DOL, Ms. Buchanan developed the IRA LLC strategy and related documents to be ERISA compliant.

Fully self directed IRAs and 401(k)s have become increasingly popular in recent years because investors are increasingly becoming dissatisfied with leaving all of their "eggs in the Wall Street basket."

It was ruled that you can be the trustee of your own IRA, using a Corporation or LLC to manage it.

TESTED BY THE COURTS IN 1996: SWANSON VS. IRS

The IRS took the Swansons to tax court in 1996, alleging that the Swansons' management of their own IRA funds was a prohibited and taxable transaction.

The tax court ruled in favor the Swansons and that's when the IRA LLC strategy began to get attention from a few key people.

SOLO 401K BORN 2001

A new law called EGTRRA created the Solo 401k: a leaner, simpler more powerful version of an IRA, made specifically for small business owners.

The Solo 401k does not require a corporation or LLC in order for you to manage your own retirement account directly.

That means you get the most powerful investing platform on the planet in a simple, easy-to-use package.

"The Solo 401k is the best way to go, given today's economy."

Brandon L. from TX

Self Directed Investor and Business Owner

Get Your Own All-In-One Solo 401k Investing System

No Custodians or Third Party Administrators Required. 100% Self Directed.

"Why Haven't I Heard Of This Before?"

FOLLOW THE MONEY

If you haven't heard of this before, there are 3 reasons:

1) Large financial institutions make money by selling traditional securities: stocks, bonds, and publicly traded funds. They earn commissions and/or fees, usually as a percentage of the money you put into stocks, bonds, and funds. For them, alternatives to traditional investments are "bad for business."

2) It is difficult and expensive for large financial institutions to administer transactions into real estate and other alternative assets.

3) Most self directed investing accounts are incomplete solutions, leaving out some of the required ingredients for success. Our Unlimited® Investing platform is the world's only complete all-in-one solution for self directed investors.

How Does This Compare To A Self Directed IRA?

FULLY self directed

IRA

(aka IRA LLC)

- Double taxation on leveraged real estate

- No loan feature

- No active profit allowed

- Low limits on contributions ($5,500/yr)

- Custodian risk

- No early retirement

- Higher costs

- More reporting

- More complexity

- Less privacy

- "Roth Prison"

fully self directed

Solo 401k

On Solo401k.com

- UDFI tax exempt (No double taxation)

- Loan Feature (Up To $50,000 Tax-Free)

- Active profit OK

- High limits on contributions ($53,000/yr)

- No custodian risk

- Early retirement OK

- Lower costs

- Less reporting

- Simpler

- More Privacy

- "Roth Freedom"

Pricing

complete all-in-one investing system

$

97

per month

- $0 Setup fee

- $0 Custodian fee

- $0 Compliance fee

- $0 Administration fee

- $0 Transaction fee

- $0 Document Maintenance fee

- $0 Annual fee